The Fair Finance Revolutionfor Small Businesses

The Fair Finance Revolutionfor Small Businesses

Release cash trapped in outstanding invoices within 24hours!

Simple transparent pricing

No hidden fees

No Debentures or Personal Guarantees

Complete your application in under 5 minutes

Only pay for the Cash you need

Fund Invoices from £100 up

Small Businesses Power the Global Economy

Why are so many denied access to fair finance?

Watch the video to find out more about ClearFactor's mission

How to get started

How Clear Factor's Ecosystem Can Help You

40% of SME’s that apply for finance, say that they apply for loans to cover a short-term shortfall in cashflow overlong-term growth.

Invoice finance gives you access to on-demand finance, while not having to expose yourself to long-term commitments.

Why Clear Factor?

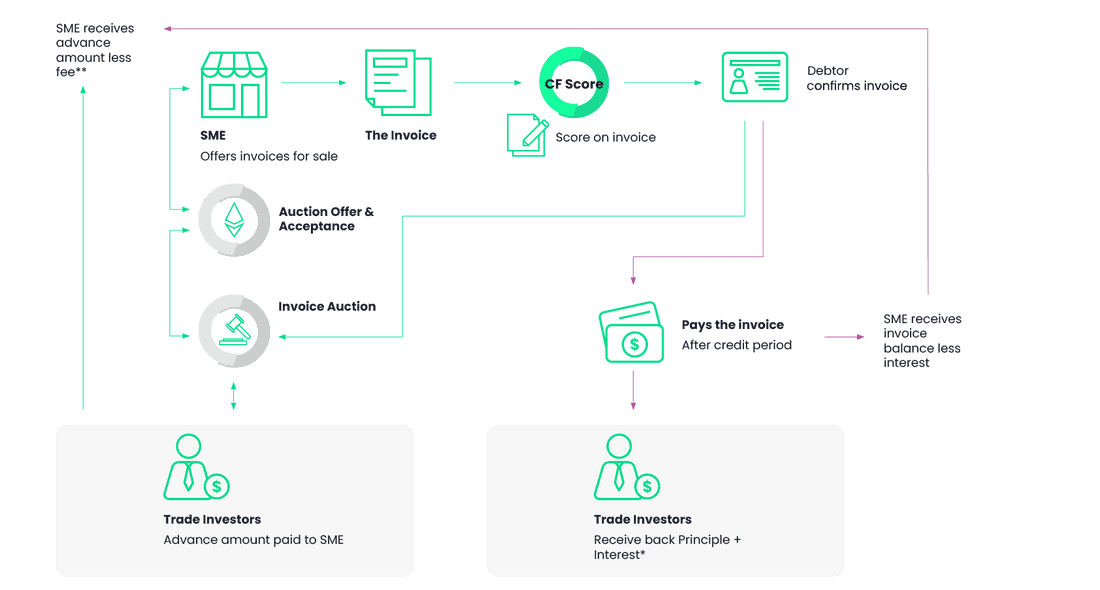

A revolutionary approach to providing businesses with essential cash flow. Clear Factor democratises invoice finance for businesses and investors alike.

Join The Fair Finance Revolution

Sign up today to join the first global invoice finance ecosystem in the world where SMEs can sell their invoices and investors can participate in the buying of those invoices.

Sign Up‘A $2.6 TRILLION MARKET EXISTS FOR INVOICE FINANCING'